are assisted living expenses tax deductible in 2019

For information on claiming. Yes the payments are deductible under medical expenses.

Final Regulations Limit The 20 Pass Through Deduction For Long Term Care Facilities Marcum Llp Accountants And Advisors

Yes in certain instances nursing home expenses are deductible medical expenses.

. June 4 2019 148 PM. Yes assisted living expenses are tax-deductible. In order for assisted living.

1 Best answer. Which means a doctor or nurse with. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible.

100 Free Federal for Old Tax Returns. For elders who live in assisted living communities part or all their assisted living expenses might qualify for a tax deduction. If their long-term care expenses are more than 10 of your gross income as of 2019 and they are considered chronically ill these expenses are tax deductible.

In 2019 this threshold will be 10. Everything is included Prior Year filing IRS e-file and more. There are special rules when claiming the disability amount and attendant care as medical expenses.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. However it depends on what that amount includes and why an individual is in catered living. Ad Prepare your 2019 state tax 1799.

Some senior living expenses including medical expenses and assisted living expenses are tax-deductible within certain parameters. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as. The medical deduction for assisted living includes all the expenses if the primary reason for living in a.

The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction. June 4 2019 148 PM. If you your spouse or your dependent is in a nursing home primarily for medical.

Can You Write Off Assisted Living On Your Taxes. In order for assisted living. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

Its important to note that each financial situation is. Deductible Assisted Living Facility Costs. Special rules when claiming the disability amount.

Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. You can also see the examples. Chronic Illness and Tax Deductible Status.

Medical expenses including some long-term care expenses are deductible if they exceed 10 of your. Certain conditions that must be met to qualify. To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the unreimbursed drug.

Medical expenses generally make up at least a portion of the monthly service and entrance fees at assisted living communities. In fact you may be able to deduct a portion of what you pay for assisted living costs. Physical factors of chronic illness include the inability to feed themselves dress bathe or get to the bathroom.

June 1 2019 707 AM. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. A TurboTax QA meanwhile explains that assisted living expenses are tax deductible when the patient cant care for themselves as certified by a licensed healthcare.

What Assisted Living Expenses are Tax Deductible. Simply add up the. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for.

Mental factors include requiring supervision for their protection.

The Tax Deductibility Of Long Term Care Insurance Premiums

Are Assisted Living Costs Tax Deductible

4 Tax Breaks That Reduce In Home Senior Care Expenses Care Com Homepay

You May Be Able To Deduct Some Ccrc Costs From Your Taxes Mylifesite

Tax Deduction For Medical And Dental Expenses The Official Blog Of Taxslayer

Is This Tax Deductible Caring For A Loved One The Turbotax Blog

Is Long Term Care Insurance Tax Deductible Goodrx

How Much Money Do I Need To Move Into A Senior Living Community Senior Lifestyle

How To Deduct Home Care Expenses On My Taxes

10 Tax Deductions For Seniors You Might Not Know About

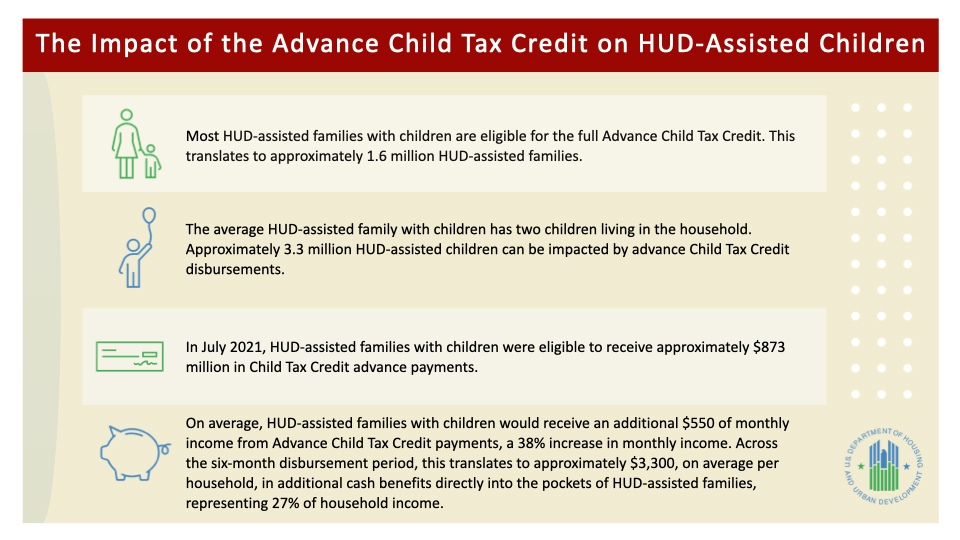

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Private Home Care Services May Be Tax Deductible

How To Pay For Nursing Homes Assisted Living